Harmony Hospitality Academy:

An Operator’s Guide to Restaurant Finance

Unlock the Power of Knowledge with Harmony Academy

With a proven track record of empowering hospitality professionals, Harmony has delivered transformative classes to operators across the country. We've partnered with renowned organizations like Re:Her, the Restaurant Association Metropolitan Washington, and the National Restaurant Association.

Now, we’re bringing that expertise directly to you. Harmony Academy offers essential financial management courses designed for hospitality managers, owners, and operators ready to take control of their business's financial. Our classes are tailored to boost your financial acumen, create a culture where financial success matters, sharpen your decision-making, and drive profitability.

The bottom line is simple: Operators who know more, make more.

Ready to level up your team’s financial savvy? Fill out the form below to schedule a class - or scroll down to explore our sample course offerings.

Restaurant 101 - Financials

Harmony’s Restaurant 101 class covers the basics of small business accounting with an intensive focus on the hospitality industry, and equips managers with essential accounting principles tailored for restaurants.

Topics covered include accrual vs. cash basis accounting, understanding the three primary financial statements, Key Performance Indicators specific to restaurants and bars, industry benchmarks, and hands-on exercises analyzing Profit & Loss statements.

Restaurant 102 - Labor Costing

Harmony’s Restaurant 102 class introduces vital strategies for managing labor costs effectively. This class is an introductory deep dive into the hospitality industry’s largest and most difficult to manage cost.

Restaurant 102 includes lessons on accurate labor tracking, an introduction to payroll taxes and benefits, fundamentals of predictive labor scheduling, best practices in labor management, and practical scheduling exercises using widely-used software.

Restaurant 103- COGS & Menu Pricing

Restaurant 103 tackles Cost of Goods concepts and Menu Pricing and guides managers through the essentials of managing food and beverage costs.

Restaurant 103 includes lessons on the COGS equation, inventory management and best practices, menu pricing techniques, menu design, and PMIX analysis, as well as practical menu pricing exercises utilizing spreadsheets and popular software.

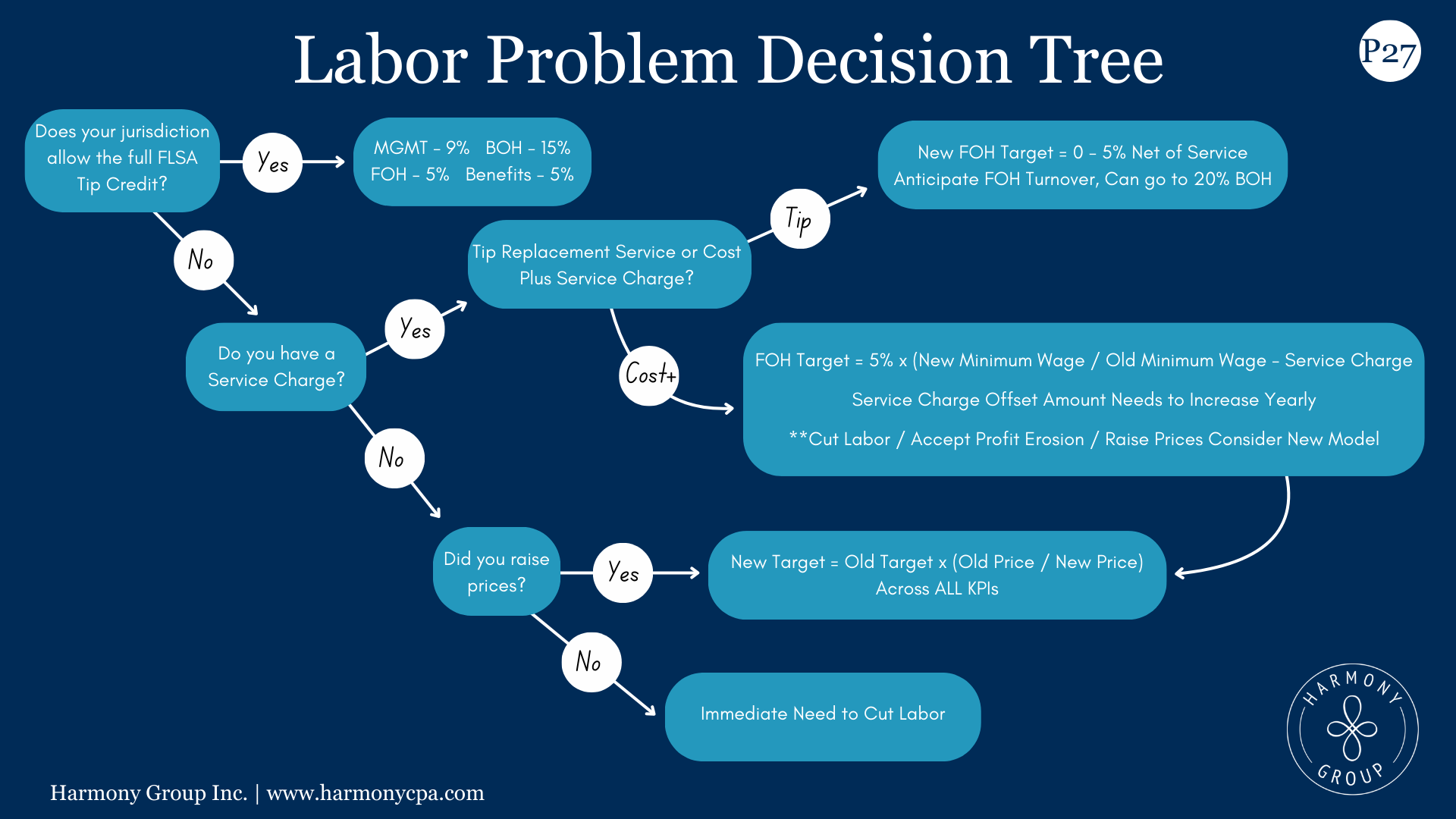

Restaurant 104 - Tips vs. Service Charge

Harmony’s Restaurant 104 class covers an increasingly important topic in our industry - the vagaries of the difference between tips and service charges, and how to stay in compliance with tax law and new legislation around both.

Restaurant 104 covers the definitions of tips and service charges, understanding the Tip Credit, service charges & sales tax, accounting for tips and service charges, and strategies for new legislation that has already hit many states and will hit many more.

Put Decades of Restaurant Accounting Expertise to Work For You

Tell us a little about your business’s needs and see if one of our courses is right for your business, or discover if we have a seminar coming up near you.